Ethereum Price Prediction PrimeXBT: Insights and Market Trends

As the cryptocurrency market continues to evolve, traders and investors alike watch Ethereum closely. With its smart contract functionality and growing DeFi ecosystem, the second-largest cryptocurrency by market cap remains a focal point for speculation and investment strategies. In this article, we will delve into Ethereum price predictions, examine market trends, and provide insights on trading strategies, utilizing tools like ethereum price prediction primexbt PrimeXBT.

Understanding Ethereum’s Market Dynamics

Ethereum (ETH) is more than just a digital currency; it is a decentralized platform that enables developers to build and deploy smart contracts and decentralized applications (dApps). Its unique features have positioned it as a leading contender in the cryptocurrency space.

The price of Ethereum is influenced by various factors including market sentiment, regulatory news, technological advancements, and macroeconomic trends. Understanding these dynamics is crucial for making informed predictions about its future price movements.

The Role of Decentralized Finance (DeFi)

Decentralized Finance has significantly contributed to the rise in Ethereum’s value. As projects like Uniswap, Aave, and Compound have gained traction, Ethereum has become the backbone of the DeFi ecosystem. This explosion of activity has resulted in greater demand for ETH as transaction fees and liquidity requirements increase.

Analysts believe that as DeFi continues to evolve, the demand for Ethereum will surge, leading to a potentially bullish outlook for its price. Investors looking to leverage this trend may find various strategies beneficial for their trading on platforms like PrimeXBT.

Technological Developments: Ethereum 2.0

Ethereum’s transition to Ethereum 2.0, which involves switching from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism, is a game changer. This network upgrade aims to increase scalability, security, and sustainability, which are crucial for long-term growth.

With the completion of Ethereum 2.0, many experts anticipate a repricing of ETH to reflect its enhanced utility and the reduced inflation rate. Investors should stay informed about the progress and potential impacts of this upgrade on Ethereum’s price.

Market Sentiment and Its Impact

The cryptocurrency market is highly sensitive to sentiment shifts. Positive news surrounding institutional adoption, regulatory clarity, or technological breakthroughs can trigger significant price hikes, while negative news can lead to sharp declines. Tools like social media sentiment analysis and on-chain data can provide valuable insights into the mood of the market.

Traders utilizing platforms like PrimeXBT can capitalize on market sentiment through leveraged trading options, allowing them to amplify potential gains while being mindful of risks involved.

Price Prediction Models

Several analytical models can aid in predicting Ethereum’s future price. Among the most popular are:

- Technical Analysis: This method utilizes historical price charts and volume data to forecast future movements. Key indicators include moving averages, Relative Strength Index (RSI), and Fibonacci retracement levels.

- Fundamental Analysis: This approach considers the intrinsic value of Ethereum by analyzing various factors such as network activity, development updates, and economic implications.

- Quantitative Models: These models often rely on complex mathematical algorithms and machine learning techniques to predict price movements based on historical data and market patterns.

Combining multiple approaches could yield a more balanced and robust price prediction for Ethereum.

Short-term vs. Long-term Predictions

Short-term price predictions for Ethereum are often volatile and can be influenced by immediate market conditions, news events, and trader sentiment. For instance, in a bullish crypto market, Ethereum could see quick rallies above key resistance levels.

Conversely, long-term predictions are typically based on broader market trends, user adoption rates, and Ethereum’s technological advancements. Many analysts believe that Ethereum could reach new all-time highs as DeFi and NFTs continue to gain popularity.

Trading Strategies on PrimeXBT

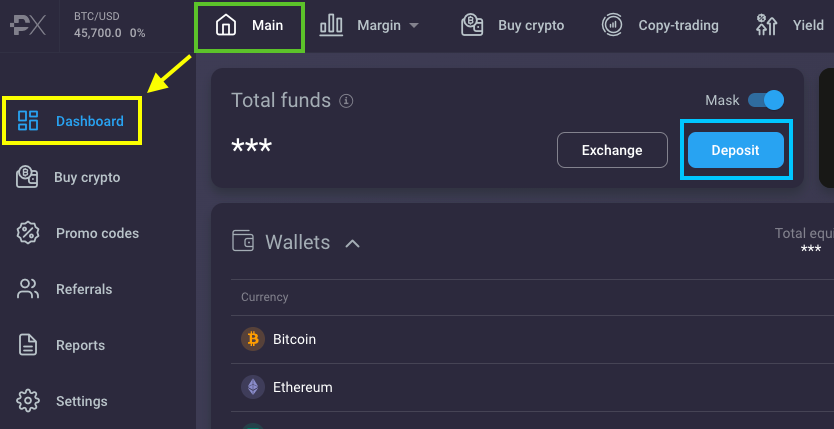

Successful trading requires not only understanding market analysis but also developing effective trading strategies. On PrimeXBT, traders can utilize a variety of strategies including:

- Day Trading: Capitalizing on short-term price movements by executing multiple trades within a single day.

- Swing Trading: Taking advantage of price swings over a period of days or weeks, targeting secure entry and exit points based on technical analysis.

- HODLing: A long-term strategy where investors buy and hold Ethereum regardless of short-term volatility, betting on future value increases.

By effectively leveraging the features of PrimeXBT, traders can adapt their strategies to current market conditions and enhance their trading outcomes.

Conclusion

Predicting the price of Ethereum involves analyzing complex market dynamics and staying informed about ongoing developments in the cryptocurrency landscape. The interplay between technological advancements, market sentiment, and macroeconomic factors is key to making informed predictions.

With its robust ecosystem and the anticipated effects of Ethereum 2.0, the long-term outlook remains positive. However, traders should remain vigilant and adapt their strategies accordingly. Armed with tools and insights available on platforms like PrimeXBT, investors are well-equipped to navigate the exciting yet volatile world of Ethereum trading.